After 6 years of investing through M1 Finance I am rolling over my accounts into my existing Fidelity account.

I originally opened the account in 2018 and at the time the advantages of pies, dollar cost averaging (DCA), free trading, fractional stocks, and a $10 minimum balance to invest outweighed the little issues I had with the platform. At the time I believed this was a great platform for investors with little available cash to invest and a long investment horizon.

However, this is no longer 2018 and the competition has caught up. On the investing side M1 only made very minor updates to the investing experience and instead chose to focus on other financial products (credit cards & high yield savings) which I simply did not need or were already equal to or inferior to what I had.

While the M1 investing experience was stagnate Fidelity used the time to catch up. First they moved to free trading. Next, they introduced fractional shares and auto transfers. The final piece added was recurring investments which would allow me to achieve the same DCA and pie like effect and it is a free. With these new features in Fidelity the little annoyances in M1 I once overlooked became more annoying and my motivation to transfer my accounts to fidelity.

In regard to Fidelity, if anyone is not familiar with how to set up recurring investments here is a summary:

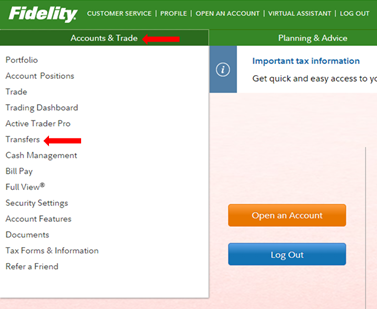

After logging into your Fidelity account choose the “Accounts & Trade” menu and then “Transfers”.

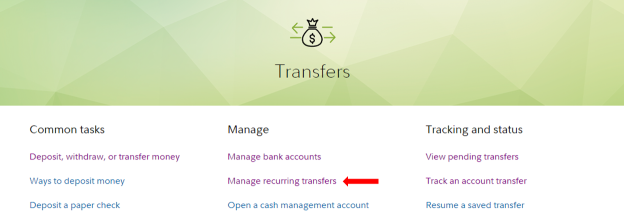

On the Transfer screen choose “Manage recurring transfers”.

Click on the Create new activity menu and setup up your recurring transfer and then setup your recurring investments. The recurring investments will be in dollar amounts so you can spread your cash transfer into multiple investments which will achieve the DCA and Pie effect.

On my migration out last year, two more annoyances hit home – the $95 ACATs fee (now $100, I think) and I ran afoul of the wash rule for the first time in years. Otherwise, after the initial delay and upsale/save tactics, mine was smooth. But that was on the Apex, rather than in-house platform. Good luck!

LikeLiked by 1 person

Yeah I got hit on the ACAT fee already. All of the whole shares have been moved over already now just waiting on the fractional stuff to get liquidated. Knew this was going to be a mess but so far so good.

LikeLike

Keep track of the pending dividends. On mine they came through in bulk payments (multiple companies without the tickers) in one transaction. I had to manually recalculate to ensure they were correct. And come might flow to Fidelity on the fulls and M1 on the partials.

LikeLike

Typo: some.

LikeLike

thank you for the tip

LikeLike

Pingback: My Recent Investing Journey | Seeking Returns