After 37 years of clocking in and out of work and religiously saving at least 10% annually in my 401K every year, my countdown to financial independence is in sight. Each month is a step closer and let’s look at how this past month is getting me there.

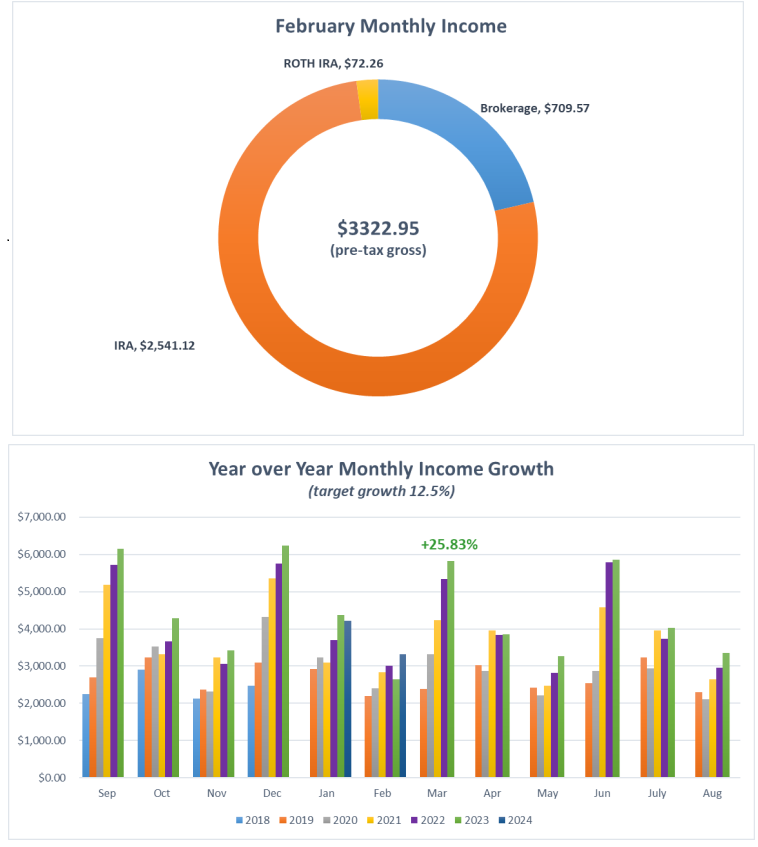

For the month of February I made $3,322.95; an increase of 25.83% versus this time last year.

Regarding raises, I received 11 dividend raises from AVA, BBY, BCE, BEP, BEPC, CPT, CVX, GRMN, MMM, PEP, & PRU that added $279.99 to my forward annual income.

In regards to my selling and consolidating positions, I sold Compass Minerals (CMP) after their lithium mining project was brought to a halt due to Utah regulators. I sold the last of my General Motors (GM) position, I sold the bulk of the stock 2 years ago and held a small position in case their Cruise technology took off, but that bet was not paying off. I sold my position in Hasbro (HAS), my patience was running out with the turn-around, so I took my profit and ran. All proceeds were reinvested into SCHD. Finally, I sold a third of my Omega Healthcare (OHI) position to reduce risk from a possible dividend cut. The proceeds from the OHI sale stayed in the REIT sector and were reinvested into CTO Realty Growth (CTO).

On the home front there have been a few things going on. First the good news my oldest daughter who lost her job in December when the start-up she worked at closed their doors permanently. After 2 months she landed a job and is now a scientist working for Yale University.

The other big news on the home front was my job. My company lost yet another significant development contract which will inevitably lead to more layoffs. Considering my age & salary I may be a target. I was hoping to go out on my terms and not be pushed out early but if it happens, I am prepared at least financially.

And the final big news I have is after running all my annually updated expenses & assets I can retire 11 months earlier than I had planned. I was nervous if what I was seeing was wrong but as per my previous post, I subscribed to NewRetirement to double check & verify. I am now confident I will be retiring in November 2025!

Enough of me babbling, here are the numbers:

Dividends Received

| Date | Symbol | Company | Amount |

| 2/1/24 | DIVO | AMPLIFY ETF TR CWP ENHANCED DIV | $123.32 |

| 2/1/24 | GIS | GENERAL MILLS INC | $112.19 |

| 2/1/24 | T | AT&T INC | $366.61 |

| 2/1/24 | VZ | VERIZON COMMUNICATIONS INC | $184.16 |

| 2/12/24 | APD | AIR PRODUCTS AND CHEMICALS INC | $80.56 |

| 2/15/24 | ABBV | ABBVIE INC | $358.87 |

| 2/15/24 | EPR | EPR PROPERTIES | $85.49 |

| 2/15/24 | HAS | HASBRO INC | $64.08 |

| 2/15/24 | IBCP | INDEPENDENT BK CORP MICH | $69.73 |

| 2/15/24 | O | REALTY INCOME CORP | $86.77 |

| 2/15/24 | OHI | OMEGA HEALTHCARE INVESTORS INC | $722.72 |

| 2/15/24 | PG | PROCTER AND GAMBLE CO | $126.49 |

| 2/20/24 | MAIN | MAIN STR CAP CORP | $44.37 |

| 2/20/24 | PSEC | PROSPECT CAP CORP | $98.13 |

| 2/23/24 | ARTNA | ARTESIAN RES CORP | $229.09 |

| 2/23/24 | WSM | WILLIAMS-SONOMA INC | $17.57 |

| 2/27/24 | NUSI | ETF SER SOLUTIONS NATIONWIDE NASDQ | $20.99 |

| 2/28/24 | XRMI | GLOBAL X FDS S&P 500 RISK | $28.29 |

| 2/28/24 | XYLD | GLOBAL X FDS S&P 500 COVERED | $60.60 |

| 2/29/24 | FAST | FASTENAL | $16.83 |

| 2/29/24 | SBRA | SABRA HEALTH CARE REIT INC | $90.32 |

| 2/29/24 | UTG | REAVES UTILITY INCOME FUND | $200.54 |

| 2/29/24 | M1 Finance | M1 DIVIDEND GROWTH ACCOUNT | $135.23 |

Dividend Changes

| SYM | 2024 | 2023 | Difference | % Change | Notes |

| ABBV | $358.87 | $234.68 | $124.19 | 52.92% | |

| APD | $80.56 | $73.67 | $6.89 | 9.35% | |

| ARTNA | $229.09 | $215.05 | $14.04 | 6.53% | |

| DIVO | $123.32 | $113.44 | $9.88 | 8.71% | |

| EPR | $85.49 | $85.49 | $0.00 | 0.00% | |

| FAST | $16.83 | $16.83 | 100.00% | 2023 Payout in Mar | |

| GIS | $112.19 | $102.68 | $9.51 | 9.26% | |

| HAS | $64.08 | $60.93 | $3.15 | 5.17% | |

| IBCP | $69.73 | $53.94 | $15.79 | 29.27% | |

| MAIN | $44.37 | $37.97 | $6.40 | 16.86% | |

| NUSI | $20.99 | $16.03 | $4.96 | 30.94% | |

| O | $86.77 | $8.16 | $78.61 | 963.36% | |

| ODC | $0.00 | $37.13 | -$37.13 | -100.00% | Sold Position |

| OHI | $722.72 | $722.72 | $0.00 | 0.00% | |

| PG | $126.49 | $122.81 | $3.68 | 3.00% | |

| PSEC | $98.13 | $98.13 | $0.00 | 0.00% | |

| SBRA | $90.32 | $88.35 | $1.97 | 2.23% | |

| T | $366.61 | $343.08 | $23.53 | 6.86% | |

| UTG | $200.54 | $200.54 | 100.00% | New Position | |

| VZ | $184.16 | $108.71 | $75.45 | 69.40% | |

| WSM | $17.57 | $14.92 | $2.65 | 17.76% | |

| XRMI | $28.29 | $28.29 | 100.00% | 2023 Payout in Mar | |

| XYLD | $60.60 | $60.60 | 100.00% | 2023 Payout in Mar | |

| M1 Finance | $135.23 | $102.85 | $32.38 | 31.48% | |

| Total | $3,322.95 | $2,640.74 | $682.21 | 25.83% |

25.83% is of course a fantastic result. Congratulations on that!! And also congratulations on 3 good news on the home front. Or 2,5 ?

Of course, it’s such an incredibly much better feeling when the job is messed up, sitting on the key to freedom. Personally, I hope for a dismissal for lack of my own initiative.

In your case, I hope that things will work out in the best way. Nice to see the crossed out numbers now brought forward in bright red !!

LikeLiked by 1 person

I should be close or crossing my FI number later this year so will definitely be there with you.

Best thing that could happen is I get dismissed summer or fall of 2025.

LikeLike

Great numbers you are rocking it.

LikeLiked by 1 person