After 35 years of clocking in and out of work and religiously saving at least 10% annually in my 401K every year, my countdown to financial independence is in sight. Each month is a step closer and let’s look at how this past month is getting me there.

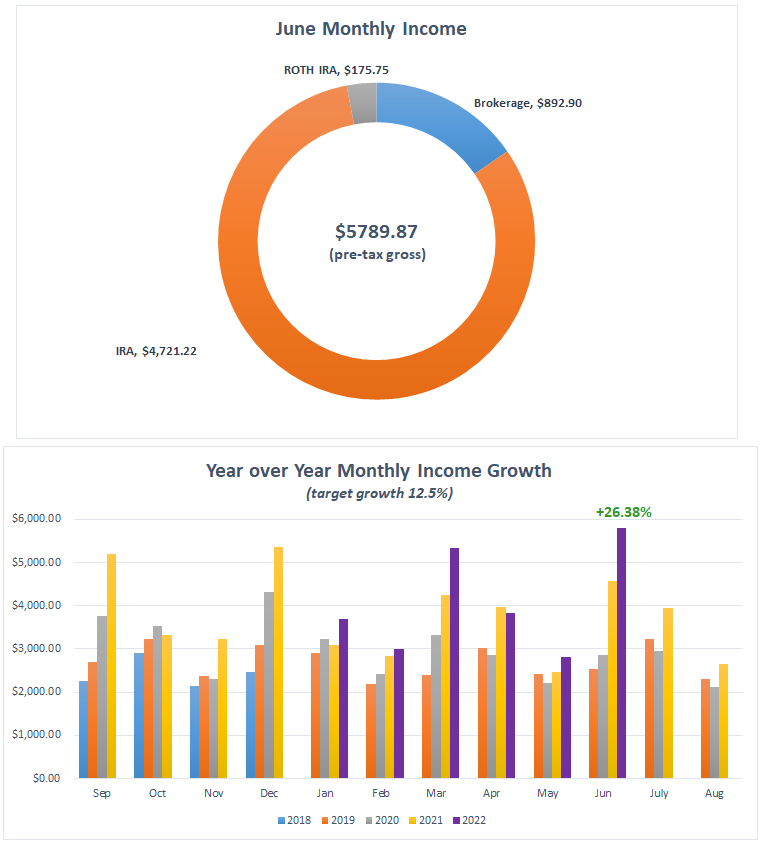

For the month of June I made $5,789.87; an increase of 26.38% versus this time last year. Biggest payout I have had this year, if only the first two months of a quarter were this nice.

In June I received 3 dividend raises from GIS, ODC and WPC. These raises will add an additional $32.70 to my annual income going forward. June is a tough month for raises so I’ll take anything that comes.

Taking a mid-year look at my annual income growth goal of 12.5%, my income is currently exceeding that goal by 3% and the bulk of that is due to the massive 49% dividend raise from United Parcel Service (UPS) back in February. Since UPS is my largest position it made a significant dent, without that I would have been closer to my goal.

On the home front I am finally caught up on maintaining properties for two homes (mine & my father-in-law’s) and I can finally start enjoying summer. Last year we started our backyard movie nights and cannot wait to get that started again, best part is we could not get a screen last year because of supply chain issues but I was able to get a 120” screen and cannot wait to try it out. My daughter caught Covid and had a side effect of something called “Covid Eye”, long story short her eye is as swollen as Rocky Balboa’s except she didn’t say cut me Mick.

On another note, fellow blogger Northern Lights Investment is back from a very dangerous surgery and is blogging again but still in need of much recovery and far from out of the woods. Also, another callout to fellow blogger Dividend Portfolio as he battles cancer and faces a tough road ahead. Try to keep both in your prayers as they can use all the help they can get.

Here are the charts we love to see:

| Date | Symbol | Company | Amount |

| 6/1/22 | ALE | ALLETE INC | $138.76 |

| 6/1/22 | DIVO | AMPLIFY ETF TR CWP ENHANCED DIV | $107.69 |

| 6/1/22 | PNW | PINNACLE WEST CAPITAL CORP | $207.96 |

| 6/1/22 | PSX | PHILLIPS 66 | $28.87 |

| 6/1/22 | SJM | SMUCKER J M CO | $18.93 |

| 6/2/22 | CMI | CUMMINS INC | $41.04 |

| 6/2/22 | UPS | UNITED PARCEL SERVICE INC | $345.18 |

| 6/3/22 | ENB | ENBRIDGE INC | $254.72 |

| 6/6/22 | SO | SOUTHERN CO | $70.24 |

| 6/7/22 | JNJ | JOHNSON &JOHNSON | $199.02 |

| 6/7/22 | VLO | VALERO ENERGY CORP | $35.28 |

| 6/8/22 | AMGN | AMGEN INC | $11.76 |

| 6/9/22 | DFS | DISCOVER FINANCIAL SERVICES | $15.61 |

| 6/9/22 | MSFT | MICROSOFT CORP | $67.84 |

| 6/10/22 | CVX | CHEVRON CORP | $23.96 |

| 6/10/22 | IBM | INTERNATIONAL BUS MACH CORP | $155.03 |

| 6/10/22 | PFE | PFIZER INC | $239.15 |

| 6/10/22 | SNA | SNAP-ON INC | $33.96 |

| 6/10/22 | WBA | WALGREENS BOOTS ALLIANCE INC | $70.07 |

| 6/13/22 | MMM | 3M CO | $63.12 |

| 6/15/22 | AVA | AVISTA CORP | $147.84 |

| 6/15/22 | EPR | EPR PROPERTIES | $85.49 |

| 6/15/22 | FAF | FIRST AMERICAN FINANCIAL CORP | $163.33 |

| 6/15/22 | NWL | NEWELL BRANDS INC | $25.56 |

| 6/16/22 | DUK | DUKE ENERGY CORP | $67.39 |

| 6/16/22 | OGN | ORGANON &CO | $5.71 |

| 6/16/22 | PRU | PRUDENTIAL FINANCIAL INC | $520.12 |

| 6/17/22 | BHB | BAR HARBOR BANKSHARES | $54.07 |

| 6/17/22 | R | RYDER SYSTEM INC | $54.57 |

| 6/17/22 | WM | WASTE MANAGEMENT INC | $46.92 |

| 6/21/22 | CMP | COMPASS MINERALS INTERNATIONAL INC | $28.65 |

| 6/21/22 | PSEC | PROSPECT CAP CORP | $98.13 |

| 6/21/22 | UL | UNILEVER PLC | $58.55 |

| 6/23/22 | QCOM | QUALCOMM INC | $177.49 |

| 6/24/22 | BP | BP PLC | $8.59 |

| 6/24/22 | KHC | KRAFT HEINZ CO | $9.70 |

| 6/24/22 | LMT | LOCKHEED MARTIN CORP | $25.80 |

| 6/27/22 | SCHD | SCHWAB US DIVIDEND EQUITY ETF | $33.46 |

| 6/28/22 | NUSI | ETF SER SOLUTIONS NATIONWIDE NASDQ | $15.93 |

| 6/29/22 | TROW | PRICE T ROWE GROUPS | $25.14 |

| 6/29/22 | XRMI | GLOBAL X FDS S&P 500 RISK | $50.36 |

| 6/29/22 | XYLD | GLOBAL X FDS S&P 500 COVERED | $146.02 |

| 6/30/22 | ARCC | ARES CAPITAL CORP | $551.61 |

| 6/30/22 | AVGO | BROADCOM INC | $8.43 |

| 6/30/22 | BEP | BROOKFIELD RENEWABLE PARTNERS | $280.60 |

| 6/30/22 | BEPC | BROOKFIELD RENEWABLE CORP | $70.08 |

| 6/30/22 | CTO | CTO RLTY GROWTH INC | $64.97 |

| 6/30/22 | GATX | GATX CORP | $55.27 |

| 6/30/22 | NEWT | NEWTEK BUSINESS SVCS CORP | $620.19 |

| 6/30/22 | PEP | PEPSICO INC | $60.72 |

| 6/30/22 | WEYS | WEYCO GROUP INC | $26.16 |

| 6/30/22 | M1 Finance | M1 DIVIDEND GROWTH ACCOUNT | $74.83 |

Hey SDG. Congrats a record dividend total in June. That YoY growth is outstanding, too.

You had some impressive dividend payers this month, including 3 paying $500+… Wow.

If I’m not mistaken (it was a long list 🙂 ), NEWT was your largest payer in June. I understand the company (currently a BDC) may re-structure into a bank holding company, which would put the current dividend at risk. Are you planning any sort of adjustment to your NEWT holding given this possibility?

The new dividends from ENB and PNW were huge. Those are some series debuts. You obviously were pretty aggressive in establishing positions in these over the past year.

I like the progress… keep it up.

LikeLiked by 1 person

I’m letting NEWT play itself out and will take the dividend hit. Short term should be some pain but long term it should recover on the dividend front and become a dividend grower. PNW was right time & place, I used to hold a large PPL position but sold that and bought PNW when share price was in the 60’s.

ENB I did go aggressive on when share price was in the 30’s. I did a blog post last June on the lack of new pipeline infrastructure and political pressure to not add more would make it a good investment so I scraped together every dollar I could and dropped it into ENB. My investment was supposed to be split with KMI but KMI’s share price wouldn’t co-operate so I just poured it all on ENB.

LikeLiked by 1 person

It’s great to see that you are ahead of your goal for income growth for the year. Seeing how your dividends have grown over the years is very inspiring. Thanks for sharing.

LikeLiked by 1 person

Thanks Bill, The next 4 years leading up to retirement will be 100% dividend growth investments and 1 year before retirement I will be building up cash. My big YoY jumps are starting to fall into that 12.5% range as I focus on lower yield but higher growth. Once I shutdown my DRIPs and retire I expect my dividend growth rate to be in the 4-5% range.

LikeLike

Hey SDG, this is pretty awesome progress, 26% YoY is fantastic! I noticed that you sold your VTRS position. I am curious as to what is your thesis there?

LikeLike

I sold it last year when VTRS initiated their dividend and it was significantly lower than Pfizer was predicting and PFE did not cut their dividend back because it was so small. I thought Mylan overstated their financials and mislead PFE so I lost trust in the new company management.

LikeLike

Nice paycheck there SDG !!

LikeLike

Thank you NLI, every time I sell and buy the new buy seems to payout in the 3rd month of a quarter. All my payouts are starting to drift into the end of quarter, at this rate I’ll only be reporting dividends 4 times a year versus 12 😂

LikeLike

I´m all over the place geographically with aprox 40% exposure in Sweden and 45% in the US and the remainder in CAD, EURO, NOK and DKK companies. But dividends are heavy in april/may because off my SEK holdings. USA is a bit more evenly distributed.

It´s not that important though where the dividends occurs. My goal is to live off last years dividends in the present year. Gives a bit more security and knowledge off present situation.

LikeLike

Fantastic SD! That’s absolutely huge and really impressive you’re still putting up that big of a growth rate considering your starting level. We had a solid month at nearly $2,200 across all of our accounts, ex-401k/HSA, so I’m pretty happy with those results.

LikeLiked by 1 person

Thanks JC, most of the growth is coming from raises and dividend reinvestment. I throw in $1K a month (which is the largest steady contribution I have made in my life) but it is making less and less of an impact. Topping out over $2K is kick-ass and so happy for your achievement. We have been following each other blogs for 10 years through ups & downs and loving the progress you are making. Crossing the $2K threshold you should start seeing something similar where the snowball is contributing more than new money. No stopping it now

LikeLike

Nice month great YOY good dividend raises also. You can see the snowball building with your portfolio. Keep adding.

LikeLike

wow what a fantastic month sd! huge growth and some monster payments, love it!

LikeLike

A couple of those monster payouts were Canadian companies 😉

LikeLike